There becomes a time when you make the adjustment from gap-year or short-term traveler to full-time international travel. In this case travel insurance just doesn’t cut it anymore since it is meant as a supplement to regular health insurance.

In my case I graduated from university in the United States nearly one year ago which took away my eligibility to share my father’s health insurance plan. On a side note next year i’ll rejoin his plan because of the new health insurance regulations that allow anyone under 26 to be a part of a parent’s plan. At that point i’ll buy travel insurance again. As someone who is self – employed with my own one man company I had no option but to find my own private health insurance. The trick being that I needed international coverage which is not commonly offered with most health insurance plans.

I ultimately chose HTH Worldwide Global Citizen

which is an Aetna PPO. The reason I have waited so long to talk about my choice is that any review of an insurance plan is useless unless the reviewer has used it. At this point after ten months on the plan I have successfully filed numerous claims with HTH Worldwide valued at nearly $10,000. This includes care in the United States, Hong Kong, and Japan. The company has fairly reimbursed my claims, covering the appropriate amount as indicated in the terms of my plan. I have both paid doctors directly and later filed claims with HTH Worldwide. I have also had doctors bill HTH Worldwide directly and have them send me a bill.

With the most important part of the review out of the way I am going to tell you about why HTH Worldwide is a good choice for the permanent travel, location independent professional type.

“When outside the U.S., connect to our network of international medical providers through premier on-line tools: browse doctor and hospital profiles, schedule appointments, and in most cases, have HTH make direct payments to providers.”

“When inside the U.S., access our comprehensive provider network made possible by Aetna. One of the largest networks available, the Aetna Passport PPO provides more than 700,000 doctors and 4,400 hospitals for you to choose from.”

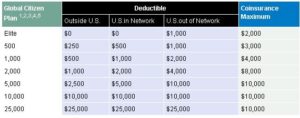

Now you can choose a specific plan based on how high a deductible you want. See the chart below for the options.

This becomes a good deal when used abroad if you believe in the idea of health insurance being useful in general. I personally browsed the members only area of the website for recommendations of hospitals and specific doctors. They have a system where the company can book an appointment but they generally are not great at this. I just checked that the doctor or hospital was in my network and booked an appointment myself which ensured a quicker turnaround time. Its not difficult because if the hospital is listed on the website they will have English speaking staff. Other times I walked into random hospitals and made appointments myself, even if they were out of network.

Some important things to note:

1. Copay waived when visiting an HTH Worldwide contracted provider.

2. Deductibles are Per Person per Policy Period.

3. The Out of Pocket Maximum is calculated by adding the deductible and coinsurance maximum together.

4. Amounts paid to satisfy a deductible are credited to all other deductibles, both inside and outside the U.S. For example, if you satisfy your Outside U.S. deductible, this amount is credited to the U.S. (In Network) and U.S. (Outside Network) deductible requirement.

5. An Insured Person only has to satisfy his/her Out of Pocket Maximum once a Year for all services received outside of the U.S. and in the U.S.

The plans also come with basic preventative and primary care where the deductible is waived for

- Primary Care Office Visits

- Office Visits/examination

- Immunizations, Lab work & X-rays

- Routine Pap Smears, annual mammogram

- PSA For Men

- Annual Physical Examination/Health Screening

- Diagnostic lab work & X-rays

As I mentioned a little bit earlier every plan comes with access to the members area. It’s pretty useful because you can file/check claim status online as well as make appointments.

Overall with very few choices available for people traveling more or less full-time this is a legitimate health insurance provider. I remember making a list of 2-3 other companies but what HTH offered was more in line with what I needed.

Adam says

Thanks for this post! My girlfriend and I will be traveling long-term before too long, and this is something that had me worried.

Locationless Living says

I am pleased to know you found the information helpful. Enjoy your trip Adam!

Anonymous says

Thanks for sharing this Information, Im planning to travel abroad and i want to apply in visitor insurance . Thanks for the post.

Visitor Insurance